CloverKnollFarms

Super Member

We pay under $400/mo for our family, for a non group plan, since we are self employed.

We are about to start paying about $150/mo.

We are about to start paying about $150/mo.

That's incredible. What kind of coverages and deductibles? Or point me at a web site.We pay under $400/mo for our family, for a non group plan, since we are self employed.

We are about to start paying about $150/mo.

You’re paying $25,200/year now , from your #’s. That’s a lot.At our age health insurance will be the biggest expense .. $2100.00 per month now and does nothing but go up every year. so over the next 8 years.. Its likely to be north of 3K a year..

^^^ This is often the case for minor things…For a BCBS bronze plan, I was paying $1700/mo.

I now have a BCBS gold plan through the healthcare market place for $1100/mo. What I'll have to be extremely careful of is how much I earn each year, but with a $600/mo savings, I can handle busting the limit a little and still come out ahead. I'll see how it stacks up this year.

Here's the kicker though. I'm finding some places won't accept plans from the healthcare marketplace. How screwed up is that?

Our healthcare system is absolutely in shambles. I went to see a Dr the other month to get a cortisone shot in an arthritic ankle. It was cheaper to pay it out of pocket for $179 (50% discount if payed in full at time of service), then to run it through insurance.

25% of US healthcare costs is in administrative. Over 2x what it is to the next highest country.^^^ This is often the case for minor things…

The delay and expense of coding and submitting and then resubmitting and reconciling is why many sole practitioners are getting out of accepting insurance or very selective…

I just looked at the bill this month.. 2177.00 per month for the 2 of us.. 26124.00 per year. I have no doubt it will be north of 30K in 8 years.You’re paying $25,200/year now , from your #’s. That’s a lot.

You mean $30k? I bet it’ll go up more than 20% in 8 years.

25% of US healthcare costs is in administrative. Over 2x what it is to the next highest country.

In the Peoples Republic of Mass... Insurance is stupid expensiveI think you could buy coverage on the marketplace for less. Wow

Being retired, my income is something I can control now, so affordable coverage is easy to find on the marketplace. Looks to be $215/mo in 2025.

I understand completely. Not to be political, this is a simple matter of costs and coverage. I fall into the "fiscally conservative, socially moderate", genre and I'm 100% in favor of a universal healthcare system. The current system is on track to bankrupt the US government and is unsustainable.Plus there are middlemen like Pharmacy Benefits Managers in every process who exist only to siphon profits out of patients. AI powered consultants that insurance companies hire to raise their denial rate and thus profits. This is why the US spends twice what any other rich county spends on health care yet we have the worst outcomes. We're the only rich country without universal health care and the only one where people are regularly rendered bankrupt and homeless due to medical bills. We have a system that only works for the 1%.

Sorry for the rant but watching my wife deal with insurance company rejection after rejection is really pissing me off. They usually pay after an appeal but that's an extra hassle that she doesn't need.

Plus there are middlemen like Pharmacy Benefits Managers in every process who exist only to siphon profits out of patients. AI powered consultants that insurance companies hire to raise their denial rate and thus profits. This is why the US spends twice what any other rich county spends on health care yet we have the worst outcomes. We're the only rich country without universal health care and the only one where people are regularly rendered bankrupt and homeless due to medical bills. We have a system that only works for the 1%.

Sorry for the rant but watching my wife deal with insurance company rejection after rejection is really pissing me off. They usually pay after an appeal but that's an extra hassle that she doesn't need.

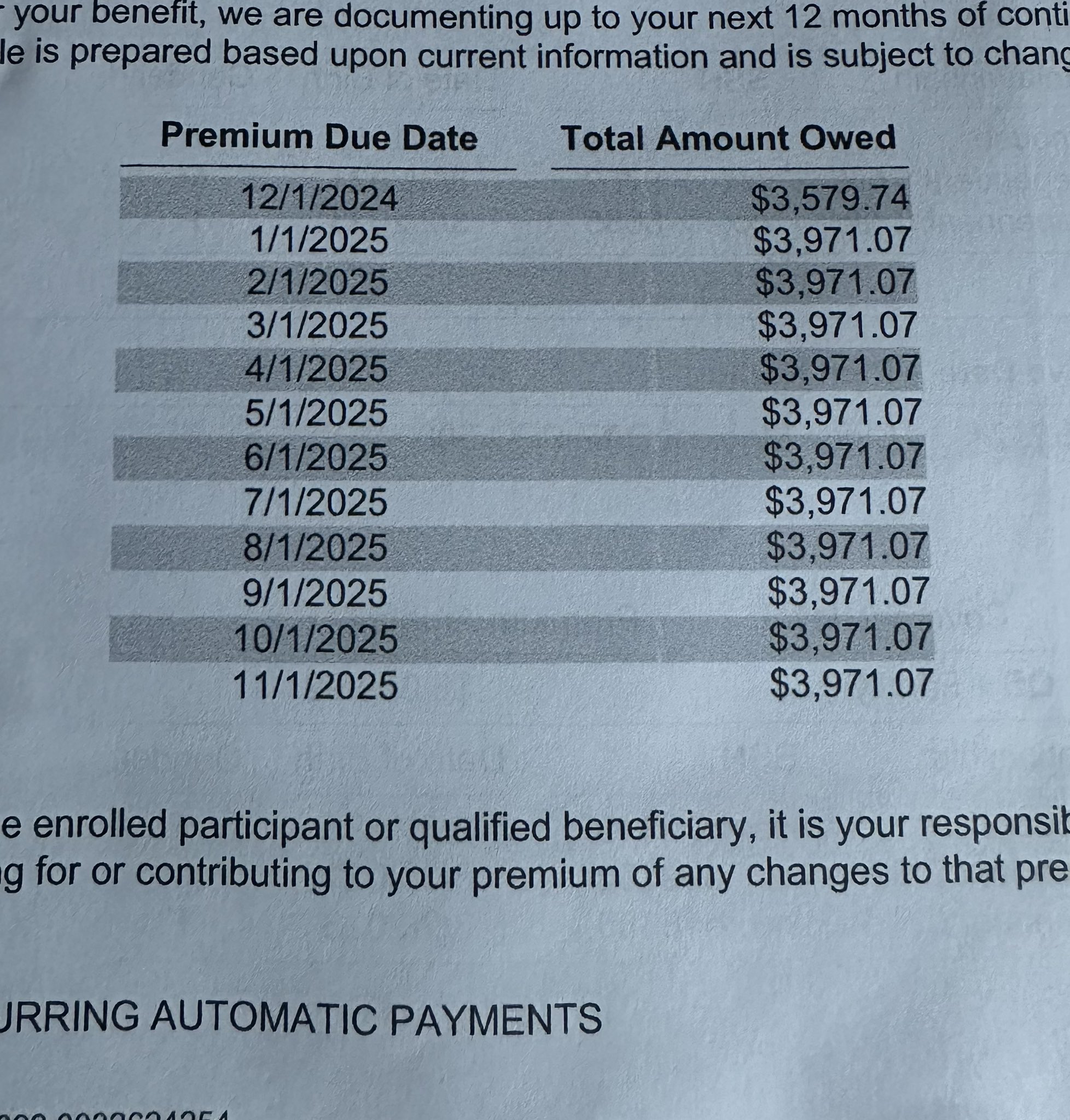

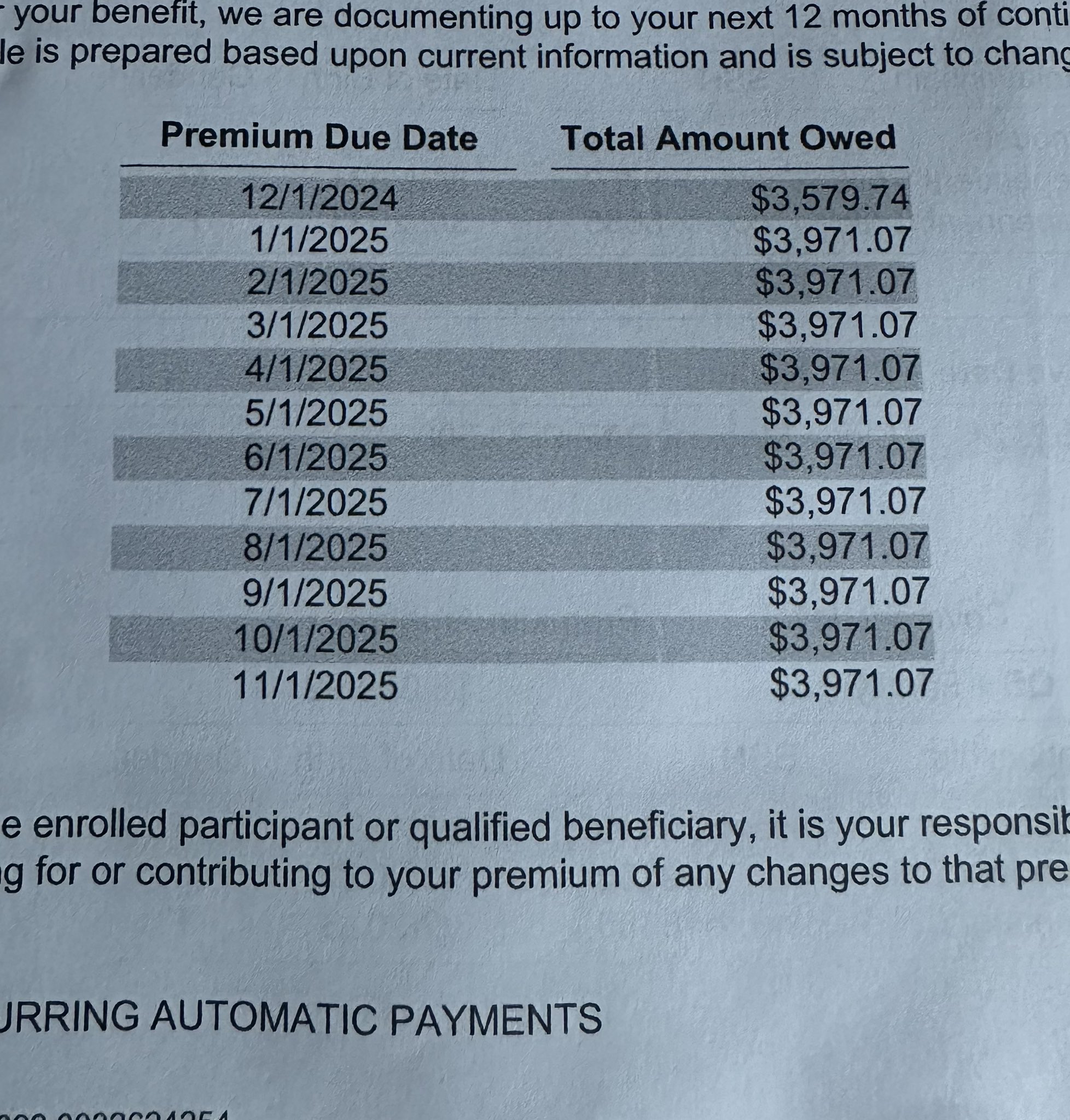

That's nothing...I just looked at the bill this month.. 2177.00 per month for the 2 of us.. 26124.00 per year. I have no doubt it will be north of 30K in 8 years.

What is complete BS is that with a family plan here.. It makes no difference how many kids are on it.. You can have 1 kid or 30 and it's the same price. It works out to a bit over 1080.00 each for my wife and myself every month..That's nothing...

A typical family premium for 2025.

People would be shocked if they knew just how much an employer was paying on their behalf.

Property taxes are our #1 expense, over $10K/yr, followed very closely by healthcare, at just under $10k/yr. This is for a no deductible, platinum plan with $20 co-pays. We could switch to a $200/mo silver plan, but the out of pocket costs would increase with high deductibles and co-pays.

I have a blood draw/test every two months, with a $20 co-pay, the insurance company gets billed $965/test. One of my prescriptions is $200/month, I pay $10 out of pocket.

It's not health insurance that is too expensive, it's health care...... All it takes is a few frequent flyers, (heart issues, cancer) and the entire insurance pool has to pay more to keep the insurance companies profitable.