Larry Caldwell

Super Member

The path to home ownership that I took is no longer available. We bought 93 acres of timber and pasture and a 22 year old 1700 sf. ranch style house in 1994, for $159,000. Property taxes were $1,000/year. The planning was that we would have it paid off by the time we retired, and the fact that there were no steps made it practical as we aged. Over the years, we used income fluctuations for home improvement, aimed at comfort and affordability rather than resale value. That was things like insulation, upgraded windows and doors, a heat pump, a deluxe kitchen, bath expansion and finishes, landscaping, a gazebo overlooking the creek, a shop building, deck repairs, a new roof, etc. It was very much "one piece at a time" home ownership. Next year the house will be 50 years old, and it incorporates most modern amenities and some that no one would expect, like a front projection home theater with a retractable projection screen and THX certified sound system. I logged 20 acres in 2013, cleared about $50k, and put it right back into the property, when contractors were eager to sharpen their pencils.The reality is if you own a home you have money to many...

If you own a home and timber land, etc... well, you might as well be rich

My biggest expense in life are taxes of all shapes and sizes...

A rental property in WA takes 8 months rent to cover property tax and another for property management and another for insurance and it is vacant at the moment...

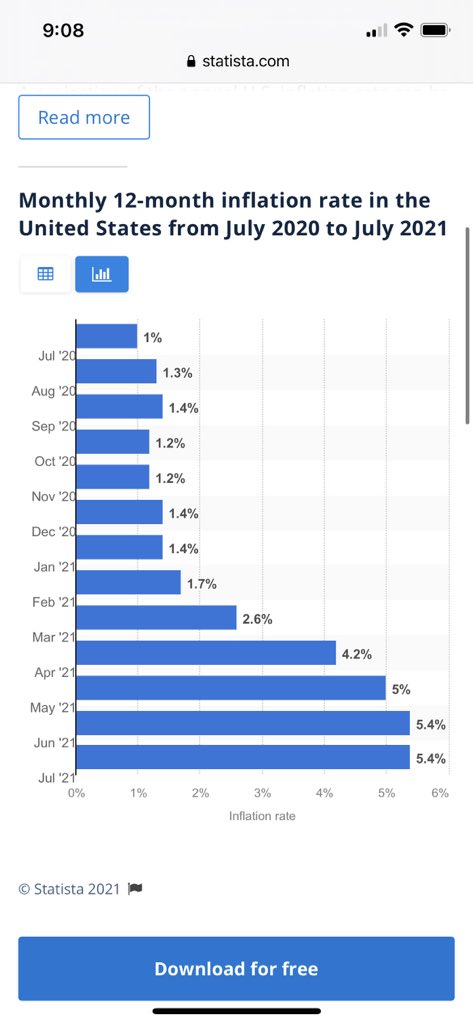

Expecting taxes to take a big leap next year...

For several years, we were a two income family living on one income. My wife is not known for being frugal, so I stuck her with paying all the bills while I saved 90% of my income. She was a top executive while she was working. In 2009 she was named C of C Woman Of The Year. We're not talking NYC salaries, but we could live comfortably on her income alone. She got the bills, I got the savings. I also got the companionship of a dynamic and fascinating woman. Having a true life partner is a great pathway to success.

Property taxes are still just $2400/year. Oregon doesn't tax SS. I figured it out a couple years ago, and my total state tax bill is about 3.5% of my gross income. The feds are another issue, starting with taxing 85% of my SS.

Anybody today would have a tough time doing what we did. In 2004, just 10 years later, a co-worker paid $275k for 40 acres and a mobile. We thought about moving in 2006, but couldn't find any comparable property under $1 million. That's nice to know. If we ever need 24/7 nursing care, we can probably sell cheap and have enough cash to die in comfort. However, anyone starting out today would be servicing a much larger mortgage, in an environment where wages have not tripled or quadrupled like real estate prices. That would blow a huge hole in anybody's cash flow.