MossRoad

Super Moderator

- Joined

- Aug 31, 2001

- Messages

- 66,634

- Location

- South Bend, Indiana (near)

- Tractor

- Power Trac PT425 2001 Model Year

Where is a safe 8% return? Even most CDs earn a whopping 1/100 of 1% interest these days. I have made larger returns in the stock market at times but this is not really safe investing.

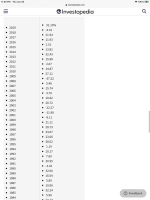

I did not say safe. I said average. As I've mentioned many times, we're in it for the long haul. We've had days where we lost plenty. We've had a year with a negative 30% return (2008). We've had a couple years with 50% returns. Over the average of the past 35 years, we've averaged right around 10%. The market averages around 8%. We strictly follow dollar cost averaging. We don't try and time the market. Most people that do ending up getting out too late, locking in their losses, and getting back in too late, by not purchasing shares when the market is at it's lowest. Those little peaks and valleys missed add up tremendously over decades.

Look, I'm not giving financial advice. I'm telling what we've done over the past 35 years of marriage. We put 15% of our income into 401Ks even when our employers weren't matching. When we weren't eligible for 401Ks, we put 15% in IRA's. When IRA's were able to be converted to ROTH IRA's, we did that immediately. We invested the 401K and IRA's in very aggressive funds from day 1 for about 30 years. We are now slowly moving them to less aggressive funds as we get nearer to retirement, but about half (mine) are still very aggressive, so I see what would seem to some people as large swings on an almost daily basis.

Yesterday the market dropped a bit. That's one of many down days in the past 12,775 days of our marriage. A blip. Today, it went up almost 1%. Another up blip in the past 12,775 days. It is still down for this week. That's 1 down week out of many down weeks of the 1820 weeks of our marriage. There have been 6 down years in the past 35 years, which means there were 29 up years. Overall, it's still up for the past month, 3 months, 6 months, 1yr, 2yrs, 5 yrs, 10yrs, 35 years.

The long haul is the picture people should focus on. Not that their 401k took a hit yesterday. Yesterday was a grain of sand on a beach of investment.

From here:

What is the average annual return for the S&P 500?