MossRoad

Super Moderator

- Joined

- Aug 31, 2001

- Messages

- 60,282

- Location

- South Bend, Indiana (near)

- Tractor

- Power Trac PT425 2001 Model Year

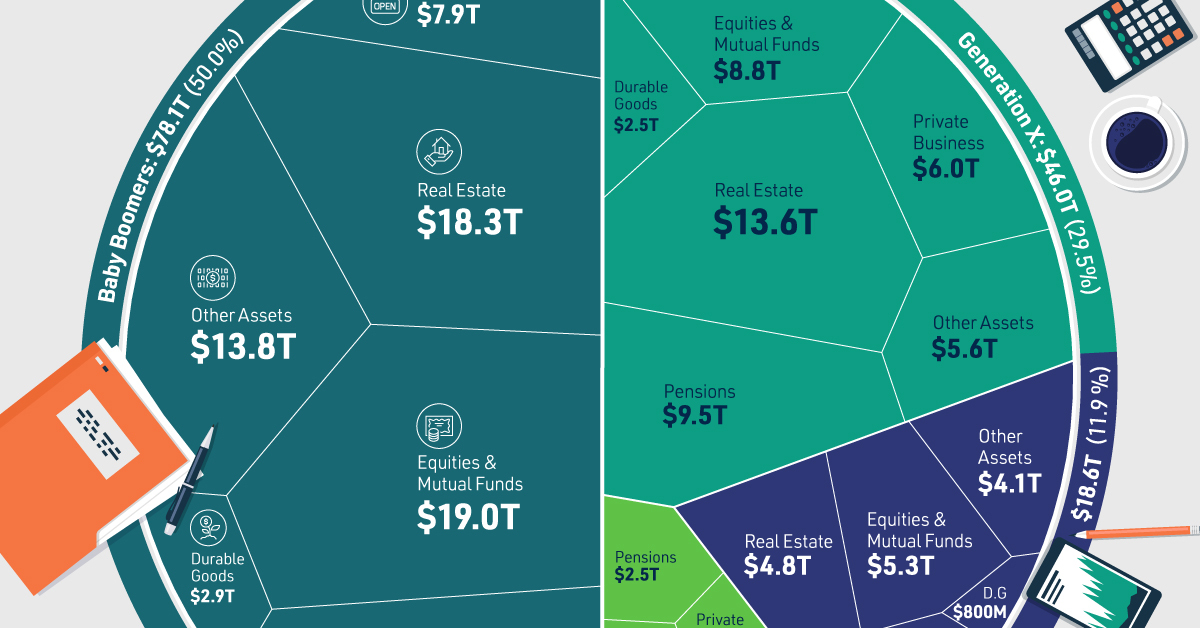

That chart does not concern me all that much.While the left side of the circle of Baby-boomers wealth is impressive we know in a few decades will have shifted to the people now on the right side. For those of us that grew up as poor farm kids of first generation land owning parents today's this wealth graph seems impossible.

Visualizing $156 Trillion in U.S. Assets, by Generation

We've visualized data from the Federal Reserve to provide a comprehensive break down of U.S. assets by generation.www.visualcapitalist.com

We're early 60s baby boomers and have been pretty successful at doubling our net worth every 7 years. The chart shows gen X as having more than half of what the baby boomers do, and they are younger by up to 30 years than the boomers. In about 7 years, they'll have double what they have now, and it'll be more than we had at that age.

. That's because of IRMAA, deduction based on AGI. Basically socialism: the more you pay in before retirement as well as the less income you have after retirement the more you receive regardless of what you paid into it all your working years.

. That's because of IRMAA, deduction based on AGI. Basically socialism: the more you pay in before retirement as well as the less income you have after retirement the more you receive regardless of what you paid into it all your working years.