Folks, I have 15 acres of land, rolling pasture with a 3/4 pond on it. It's in central NC. Does anyone lease their land out? I have a gentleman that points about 10 cows on it and also collects about 20 of the big bales of hay from it. By mowing, he does keep it maintained for me which I always considered a wash. Does anyone know what lease rates are about for land like that? I, more or less, recover the property taxes on this one... Thanks all!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How much to lease land?

- Thread starter Brianczaw

- Start date

- Views: 3931

More options

Who Replied?

/ How much to lease land?

#1

Rockbadchild

Elite Member

To me you are on par by getting your tax paid for the lease.

ponytug

Super Member

In my experience, lease rates are highly, highly local. If it were me, I would browse the bulletin board at your local feed store/coop, and FB marketplace, but I wouldn't consider things that aren't local.

All the best,

Peter

All the best,

Peter

paulsharvey

Super Member

Maybe upto $750/year. Don't know what property taxes are there, or if that covers it; but atleast it should keep you ag exempt.

I've heard of $12/month/acre for Improved pasture, with fence and water, which could be as high as $1700/year; but i don't know how "improved" it is?

I've heard of $12/month/acre for Improved pasture, with fence and water, which could be as high as $1700/year; but i don't know how "improved" it is?

ericm979

Super Member

USDA publishes prices for a lot of things including pasture leases.

of course average per state is still a large area.

of course average per state is still a large area.

California

Super Star Member

- Joined

- Jan 22, 2004

- Messages

- 16,651

- Location

- An hour north of San Francisco

- Tractor

- Yanmar YM240 Yanmar YM186D

Common rent here, is enough to cover property taxes plus the tenant maintains fences, repairs to the water supply, grading the lane etc so that its hands off from the owner's perspective.

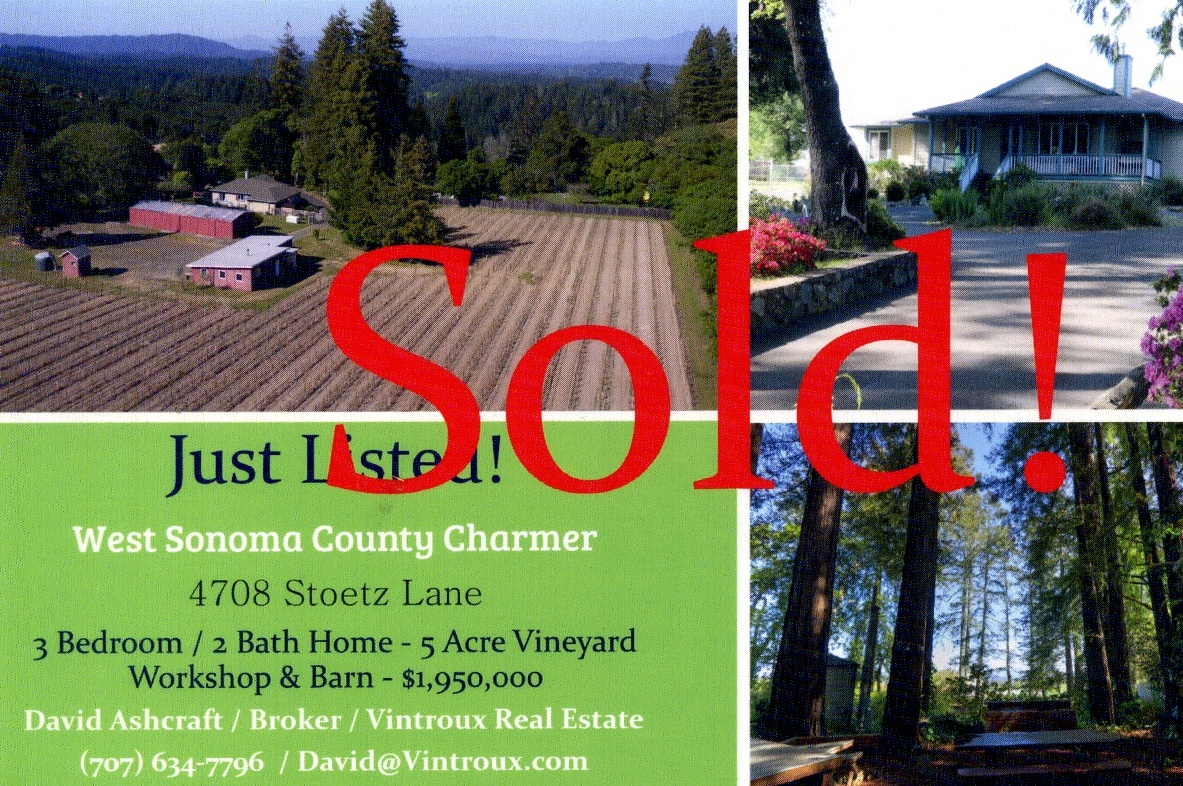

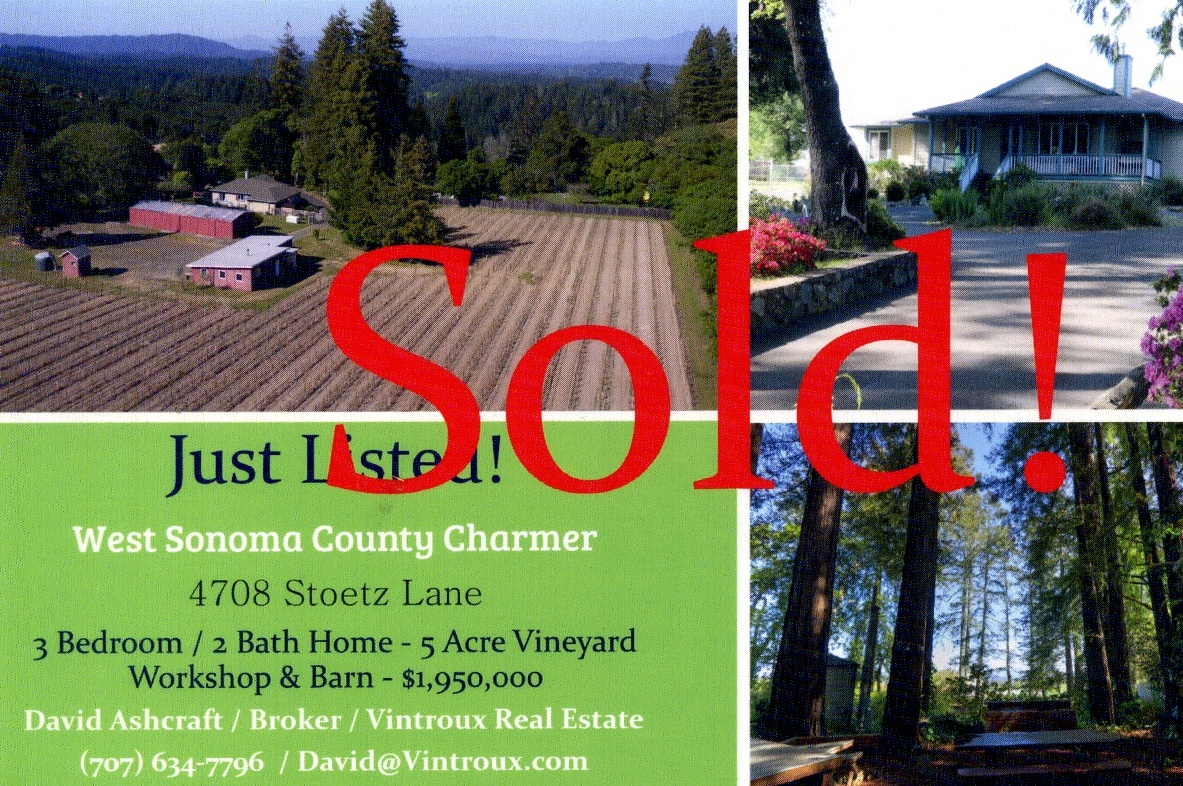

But in the broader sense here (SF Bay region) land not farmed by the owner, is mostly held as an appreciating asset waiting for conversion to a horsey hobby farm or a rural subdivision. Or in my immediate area, to a hobby elite vineyard intended mostly to impress the owner's peers. I get proposals continually from realtors emphasizing what I could get if I sold. Example below. No thanks, I'm happy with my century-old apple orchard. I'm the third generation to use it as a hobby farm. It's like walking in a park while a vineyard would be boring to walk around in.

But in the broader sense here (SF Bay region) land not farmed by the owner, is mostly held as an appreciating asset waiting for conversion to a horsey hobby farm or a rural subdivision. Or in my immediate area, to a hobby elite vineyard intended mostly to impress the owner's peers. I get proposals continually from realtors emphasizing what I could get if I sold. Example below. No thanks, I'm happy with my century-old apple orchard. I'm the third generation to use it as a hobby farm. It's like walking in a park while a vineyard would be boring to walk around in.

The above is my situation too. I just use the pond to fish. It’s good pasture and the leasee takes good care of it, so we are doing good with it. I appreciate all the advice and tips. We are right in line with everyone’s suggestions. The cows haven’t been in it for 2 years now so the pond looks good. The renter does get some nice feed from it, so I guess it’s a win/win.

EddieWalker

Epic Contributor

I'm renting 40 acres of semi open pasture with three ponds, and a very old fence on it for $15 an acre. I get a check for $600 every year, and he mows it, fixes the fence, cleans up fallen branches, and takes care of the place for me.

The land is 62 miles from where I live, and now I only go there a few times a year. It's a huge relief not "HAVING" to go there all the time to maintain it or work on it.

He also runs cattle on the land, so I get the Ag Exemption on my property taxes, which is a really big deal.

My goal for the land is to let it increase in value until I retire, and then hopefully, sell it for a good profit. Until then, having somebody else take care of it is the best option for the land.

The land is 62 miles from where I live, and now I only go there a few times a year. It's a huge relief not "HAVING" to go there all the time to maintain it or work on it.

He also runs cattle on the land, so I get the Ag Exemption on my property taxes, which is a really big deal.

My goal for the land is to let it increase in value until I retire, and then hopefully, sell it for a good profit. Until then, having somebody else take care of it is the best option for the land.

ultrarunner

Epic Contributor

- Joined

- Apr 6, 2004

- Messages

- 28,913

- Tractor

- Cat D3, Deere 110 TLB, Kubota BX23 and L3800 and RTV900 with restored 1948 Deere M, 1949 Farmall Cub, 1953 Ford Jubliee and 1957 Ford 740 Row Crop, Craftsman Mower, Deere 350C Dozer 50 assorted vehicles from 1905 to 2006

Just read time is running out for apple orchard owners as the large century old processor is pulling up stakes and leaving California…

Reason is the volume of apples produced continues to decline…

Maybe California apple trees will soon be too far from the processors to process…

www.ktvu.com

www.ktvu.com

Reason is the volume of apples produced continues to decline…

Maybe California apple trees will soon be too far from the processors to process…

Sonoma County's 101-year-old apple processing plant leaving town

Sonoma County's last and only apple processing plant in Sebastopol is leaving town.

Common rent here, is enough to cover property taxes plus the tenant maintains fences, repairs to the water supply, grading the lane etc so that its hands off from the owner's perspective.

But in the broader sense here (SF Bay region) land not farmed by the owner, is mostly held as an appreciating asset waiting for conversion to a horsey hobby farm or a rural subdivision. Or in my immediate area, to a hobby elite vineyard intended mostly to impress the owner's peers. I get proposals continually from realtors emphasizing what I could get if I sold. Example below. No thanks, I'm happy with my century-old apple orchard. I'm the third generation to use it as a hobby farm. It's like walking in a park while a vineyard would be boring to walk around in.

Last edited:

walhondingMF

Platinum Member

- Joined

- Mar 30, 2022

- Messages

- 768

- Tractor

- 2012 MF2400

I have a similar question. I've been considering leasing land for hunting. Per week, per year, etc. How would one start making up pricing for something like this?

ponytug

Super Member

I think the only way is to talk to lots of local hunters (and non-locals who come for the hunting) and landowners to find out the going rate, but even then it is going to depend on what you land is like for the target species, and what you do to promote it.I have a similar question. I've been considering leasing land for hunting. Per week, per year, etc. How would one start making up pricing for something like this?

I think that these sorts of leases are examples of very local and idiosyncratic pricing, as it really isn't relevant what "Bob" down the road gets if his property is in any way different.

All the best,

Peter

paulsharvey

Super Member

There is an AirBnB type thing for outdoor sporting properties. Search Vortex Podcast, they did a talk with them. I've mentioned it before on on of these threads (Maybe Eddie Walkers about his property), but i forget the name of the site.I have a similar question. I've been considering leasing land for hunting. Per week, per year, etc. How would one start making up pricing for something like this?

paulsharvey

Super Member

Landtrust

walhondingMF

Platinum Member

- Joined

- Mar 30, 2022

- Messages

- 768

- Tractor

- 2012 MF2400

Great resource. Thank you.

California

Super Star Member

- Joined

- Jan 22, 2004

- Messages

- 16,651

- Location

- An hour north of San Francisco

- Tractor

- Yanmar YM240 Yanmar YM186D

Yep. I read in the local paper that a major part of the local processing plant's input cost, is transportation from the far larger orchards in Washington State. It would be grossly unprofitable to ship apples in the opposite direction, up to eastern Washington, after the plant moves there.Just read time is running out for apple orchard owners as the large century old processor is pulling up stakes and leaving California…

Reason is the volume of apples produced continues to decline…

Maybe California apple trees will soon be too far from the processors to process…

When I toured the local plant 25 years ago it looked like it was from the era when power came from overhead shafts and belts, pre-electricity, with minimal updates in the modern era. I'm not surprised that they can't scale down to match the lessening local input volume.

I'm studying what I will do after this year. Mowing to reduce fire hazard is mandatory. I think the cost of insurance to run a you-pick operation (people fall out of trees!) would be excessive, and I would be competing against the other orphaned growers. A third of a mile of one-way easement wouldn't be good access for the public.

I don't intend to convert to grapes as all my neighbors have done. We enjoy the park-like atmosphere of a mature orchard. With (inherited, Prop 13) low property tax, we can afford to simply carry on using the place for a summer home same as two generations of ancestors.

Surrounded by vineyards that replaced apples in the past 20 years.

Life is good. We don't need a vineyard to enjoy the place.

Last edited:

ultrarunner

Epic Contributor

- Joined

- Apr 6, 2004

- Messages

- 28,913

- Tractor

- Cat D3, Deere 110 TLB, Kubota BX23 and L3800 and RTV900 with restored 1948 Deere M, 1949 Farmall Cub, 1953 Ford Jubliee and 1957 Ford 740 Row Crop, Craftsman Mower, Deere 350C Dozer 50 assorted vehicles from 1905 to 2006

With the tax changes do you think the kids will keep or sell the place if they inherit?

Our friends that grow grapes in Washington are doing ok…

Some in Napa and Sonoma not so well… it’s almost sounds like too many acres in grapes to keep it lucrative.

Our friends that grow grapes in Washington are doing ok…

Some in Napa and Sonoma not so well… it’s almost sounds like too many acres in grapes to keep it lucrative.

Laws vary by state. However, we have laws here to protect the farmer unless he's doing something stupid like supplying ladders. It might be worth checking out if you aren't already familiar with applicable laws.I think the cost of insurance to run a you-pick operation (people fall out of trees!) would be excessive, and I would be competing against the other orphaned growers

And don't depend on your insurance agent to explain laws; they are going to go with the company line of minimal exposure while charging maximum rates.

California

Super Star Member

- Joined

- Jan 22, 2004

- Messages

- 16,651

- Location

- An hour north of San Francisco

- Tractor

- Yanmar YM240 Yanmar YM186D

So far our inherited low tax assessment holds after inheriting,With the tax changes do you think the kids will keep or sell the place if they inherit?

Our friends that grow grapes in Washington are doing ok…

Some in Napa and Sonoma not so well… it’s almost sounds like too many acres in grapes to keep it lucrative.

[Revised paragraph]: But the Prop 13 terms have been amended recently to require the heir to move in to inherit the low rate, and the property must have been the primary home of the deceased. It isn't in our case. I voted against Prop 13, it's grossly inequitable, but it has allowed me to keep the place at minimal cost.

Both daughters love the place. One is making the sort of income to do what I did, accumulate savings to buy out the other sibling. It's not resolved whether other daughter wants joint ownership or cash. They may be forced to sell because of the increased property tax along with the cost to maintain all the crumbling infrastructure - house, guest cabin, barns, access road - potentially overwhelming. I spend hundreds of hours per year on things that would cost them a lot to hire done. Dad advised me to bulldoze and start fresh, a few decades later this will apply doubly to them. I don't mind my continual projects on the buildings, orchard, and maintaining two 40 year old tractors, but having others do this may be overwhelming.

Yes I'm hearing that grape growers here (North Bay, Sonoma County) are in trouble. The contractor who prunes, tills, harvests for me (and a couple more apple orchards) says his vineyard maintenance contracts are nearly unprofitable, he can't afford to hire a working foreman to do much of what he does. Some recent years he hasn't had a market for his entire grape crop from the several parcels.

I'm getting too old for this!

Building code? What's that?

Last edited:

ericm979

Super Member

We know someone in Sonoma who had an apple orchard. He's pulling it out and turning his place into a "horse property". Says it will be worth more when he or his heirs eventually sell it, and less work in the mean time.

Here are some similar links:

- Replies

- 17

- Views

- 3K