Working on purchasing a trackloader as discussed in my earlier thread "Economy PTO & Creeper". I found a loader prior to the one I am looking at now on machinery trader and clicked on the finance tab that they include on all of their listings. Figuring a 2nd quote on financing would not hurt. My rate from the dealer through CNH financing was 5.9%. When you click the finance tab it takes you to a page for "Express" which I later found out is through "Currency Capital" Currency Capital - Equipment Financing - Lending - Technology You will find this company when clicking the finance tab on all of the major sites such as machinery trader, tractor house, auction time, etc.

Seeing they are the advertised lender for all of the major equipment sights I assumed they would be reputable. A few clicks and couple of forms to fill out and I quickly had an email from their Rep John. Below is the email correspondence. His in red, mine in blue.

Jeremy,

I received your finance inquiry for the 2015 New Holland C238 through MachineryTrader.com.

How long of a term are you seeking? OR Are you still looking for financing?

We can structure anywhere from 12-72 months.

Thanks,

John Brozovic

currency

Account Executive

O: (310) 909-5042

Hi John,

thanks for the reply. I did not complete the form as I received a call while working on it that the machine did not have the features listed. I may be looking for financing if I can find what I'm looking for.

Jeremy

Hi Jeremy,

Thanks for getting back to me on this. I have sent another application out to this email through the website DocuSign for your convenience. We do soft pulls on the credit, so securing an approval will not cost you anything.

We can also work with any private party seller or dealership, so securing your approval is typically the first step in the process. If you have any questions you can reach me here or at my direct line 310-909-5042.

Thanks

At this point I filled out the app in order to get approval and a finance rate to compare to my rate of 5.9% from the dealer through CNH.

Jeremy,

Congratulations you are approved for the $45,000! Here are the options we have currently;

0% Down, up to 66 Months, 6.10% Interest

10% Down, up to 72 Months, 4.96% Interest

Both programs are principle only, so you can pay them off anytime without any penalty. Additional fees would include one of the following;

$340 for documentation fees if the transaction is from a registered dealer/equipment vendor

OR

$435 for documentation fees if the transaction is from a private party seller

Would want to do the 10% down plan and either 60 or 72. Thanks John. Will let you know if needed.

Jeremy

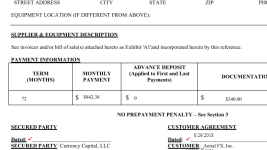

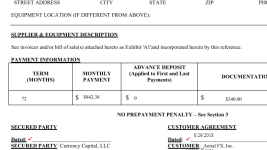

After emailing again and informing I wanted to finance the $45,000 at 4.96% for 72 months I received the following docusign contract via email asking me to sign and complete for the financing. Red flag immediately when I noticed the payment amount of $842 for 72 months and nowhere could I find an interest rate listed in the documents.

Running a loan calc the payments should have been around $726. Below are the followup emails.

Hi John,

the numbers are not adding up to me on the term length vs payment amount at 4.9%. Can you verify this is listed correctly on the document? Looks like it list 72 month term with a payment amount of $842.38. That should be more in line with a 60 month term at 4.9%. By my calculations a 72 month term would be closer to a payment of $726.

Jeremy

Jeremy,

Correct the payments are off. 72 months on 45,245.29 at 4.9% should be 815.35 a month. Here's how I got that;

Monthly Payment x Term Length = Total Payback going full term

815.35 x 72 = 58,705.20

Total Payback Finance Amount = Interest Paid

58,705.20 45,245.29 = 13,459.91

Interest Paid / Number of Years = Interest Per Year Paid

13,459.91 / 6 = 2,243.31

Interest Per Year Paid / Finance Amount = Annual Interest Rate

2,243.31 / 45,245.29 = 4.9%

John this is not correct and you know that. Interest per year should go down each year as the principle is reduced. You do not pay interest on the full principle each year. The interest paid per year gets less as the principle is reduce. 72 months should be $727 with total interest paid of $7069. Getting ready to walk from your company if this is how you operate. Your rate is around 9%

Jeremy

How did you come to that number?

Run any loan calc online. You are charging for interest on principle that doesnt exist as the loan is paid down. I will go through CNH. My payments through them at 5.9% 72 month is $747. Your practice is very shady.

Jeremy

Jeremy,

There are several ways to calculate interest. I gave you the number provided to my by underwriting. If you were to use an amortized calculator, the way you would for a mortgage or consumer loan, you would effectively reach the rate you are getting of 9%.

I am sorry for the confusion, and if you have a better opportunity at CNH I would suggest you take that offer.

Best

John,

Sorry for the long read but thought it might be important to share, especially since this lender is the direct lender used on all of the major equipment sites when you click on their financing tab. They are charging interest rate on the original principle amount borrowed each and every year, not on the actual principle amount you owe after paydown.

Seeing they are the advertised lender for all of the major equipment sights I assumed they would be reputable. A few clicks and couple of forms to fill out and I quickly had an email from their Rep John. Below is the email correspondence. His in red, mine in blue.

Jeremy,

I received your finance inquiry for the 2015 New Holland C238 through MachineryTrader.com.

How long of a term are you seeking? OR Are you still looking for financing?

We can structure anywhere from 12-72 months.

Thanks,

John Brozovic

currency

Account Executive

O: (310) 909-5042

Hi John,

thanks for the reply. I did not complete the form as I received a call while working on it that the machine did not have the features listed. I may be looking for financing if I can find what I'm looking for.

Jeremy

Hi Jeremy,

Thanks for getting back to me on this. I have sent another application out to this email through the website DocuSign for your convenience. We do soft pulls on the credit, so securing an approval will not cost you anything.

We can also work with any private party seller or dealership, so securing your approval is typically the first step in the process. If you have any questions you can reach me here or at my direct line 310-909-5042.

Thanks

At this point I filled out the app in order to get approval and a finance rate to compare to my rate of 5.9% from the dealer through CNH.

Jeremy,

Congratulations you are approved for the $45,000! Here are the options we have currently;

0% Down, up to 66 Months, 6.10% Interest

10% Down, up to 72 Months, 4.96% Interest

Both programs are principle only, so you can pay them off anytime without any penalty. Additional fees would include one of the following;

$340 for documentation fees if the transaction is from a registered dealer/equipment vendor

OR

$435 for documentation fees if the transaction is from a private party seller

Would want to do the 10% down plan and either 60 or 72. Thanks John. Will let you know if needed.

Jeremy

After emailing again and informing I wanted to finance the $45,000 at 4.96% for 72 months I received the following docusign contract via email asking me to sign and complete for the financing. Red flag immediately when I noticed the payment amount of $842 for 72 months and nowhere could I find an interest rate listed in the documents.

Running a loan calc the payments should have been around $726. Below are the followup emails.

Hi John,

the numbers are not adding up to me on the term length vs payment amount at 4.9%. Can you verify this is listed correctly on the document? Looks like it list 72 month term with a payment amount of $842.38. That should be more in line with a 60 month term at 4.9%. By my calculations a 72 month term would be closer to a payment of $726.

Jeremy

Jeremy,

Correct the payments are off. 72 months on 45,245.29 at 4.9% should be 815.35 a month. Here's how I got that;

Monthly Payment x Term Length = Total Payback going full term

815.35 x 72 = 58,705.20

Total Payback Finance Amount = Interest Paid

58,705.20 45,245.29 = 13,459.91

Interest Paid / Number of Years = Interest Per Year Paid

13,459.91 / 6 = 2,243.31

Interest Per Year Paid / Finance Amount = Annual Interest Rate

2,243.31 / 45,245.29 = 4.9%

John this is not correct and you know that. Interest per year should go down each year as the principle is reduced. You do not pay interest on the full principle each year. The interest paid per year gets less as the principle is reduce. 72 months should be $727 with total interest paid of $7069. Getting ready to walk from your company if this is how you operate. Your rate is around 9%

Jeremy

How did you come to that number?

Run any loan calc online. You are charging for interest on principle that doesnt exist as the loan is paid down. I will go through CNH. My payments through them at 5.9% 72 month is $747. Your practice is very shady.

Jeremy

Jeremy,

There are several ways to calculate interest. I gave you the number provided to my by underwriting. If you were to use an amortized calculator, the way you would for a mortgage or consumer loan, you would effectively reach the rate you are getting of 9%.

I am sorry for the confusion, and if you have a better opportunity at CNH I would suggest you take that offer.

Best

John,

Sorry for the long read but thought it might be important to share, especially since this lender is the direct lender used on all of the major equipment sites when you click on their financing tab. They are charging interest rate on the original principle amount borrowed each and every year, not on the actual principle amount you owe after paydown.

Last edited: